Which GenAI tools are law firms using?

The SKILLS 2025 Generative AI Use Cases Survey offers a rare, data-driven look at how large law firms are actually using AI tools today.

Presented by Oz Benamram, who leads the Strategic Knowledge & Innovation Legal Leaders Summit (SKILLS), the survey gathered responses from over 100 knowledge and innovation leaders at major law firms in early 2025. The results, shared at the SKILLS Summit, show important trends in tool adoption, strategic planning, and the evolving role of innovation teams.

In this article, we’ll analyze the survey’s key findings and discuss what they mean for law firm innovation and knowledge management leaders. From the sheer number of AI solutions in play (the average firm has 18 “live” AI tools, plus several in pilots – see Slide 3), to how firms are organizing around AI strategy, to which use cases and products are gaining traction, the survey paints a comprehensive picture of GenAI in BigLaw.

As Oz shared with Artificial Lawyer this is a landscape where no single AI tool rules them all and where innovation departments are taking the lead on AI strategy. Before diving into the detailed findings, it’s worth mentioning Benamram’s overarching observation: “Rather than one AI tool ruling all, firms are deploying highly specialized solutions across 22 different use cases”, leaving many areas where dozens of firms are still saying “no” to using AI at all. In other words, adoption is broad but shallow in places, and there’s plenty of room for growth.

Survey Overview and Methodology

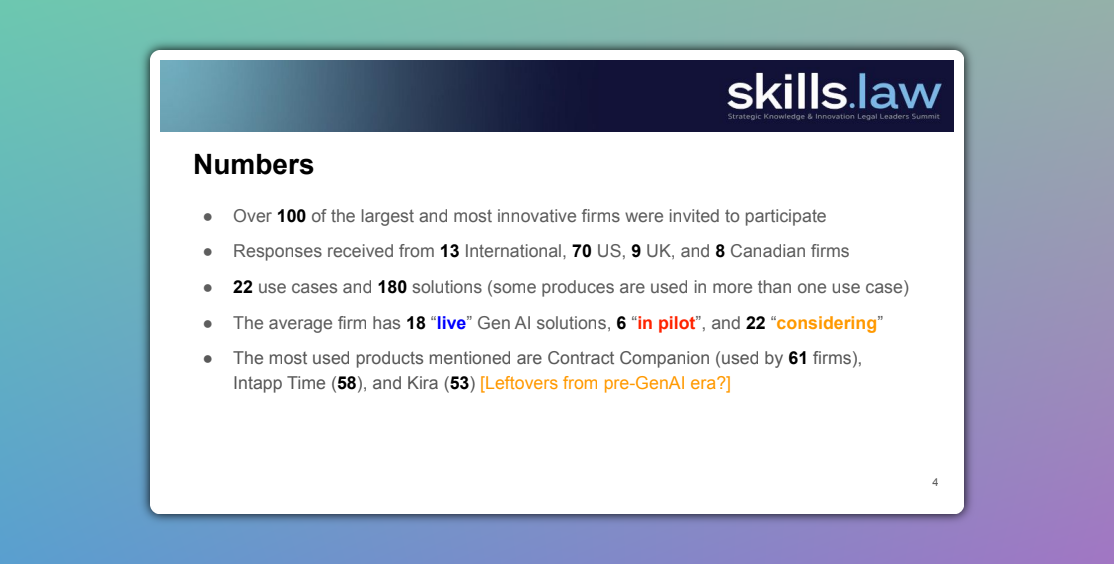

The SKILLS Summit organizers invited over 100 of the largest and most innovative law firms globally to participate, and received responses from a mix of U.S., UK, Canadian, and international firms. This cohort represents many of the firms at the forefront of legal tech innovation. The survey, conducted in Q1 2025, asked detailed questions about generative AI use cases and solutions in use at these firms. In total, respondents reported on 22 use case categories and around 180 unique AI products (since many tools appear in multiple use cases).

On average, each responding firms had 18 AI solutions live, 6 more in pilot, and around 22 in planning or consideration. In other words, the typical large firm is juggling dozens of AI initiatives. However, as we’ll see, actual user adoption of these tools is still limited, an issue of change management rather than lack of technology.

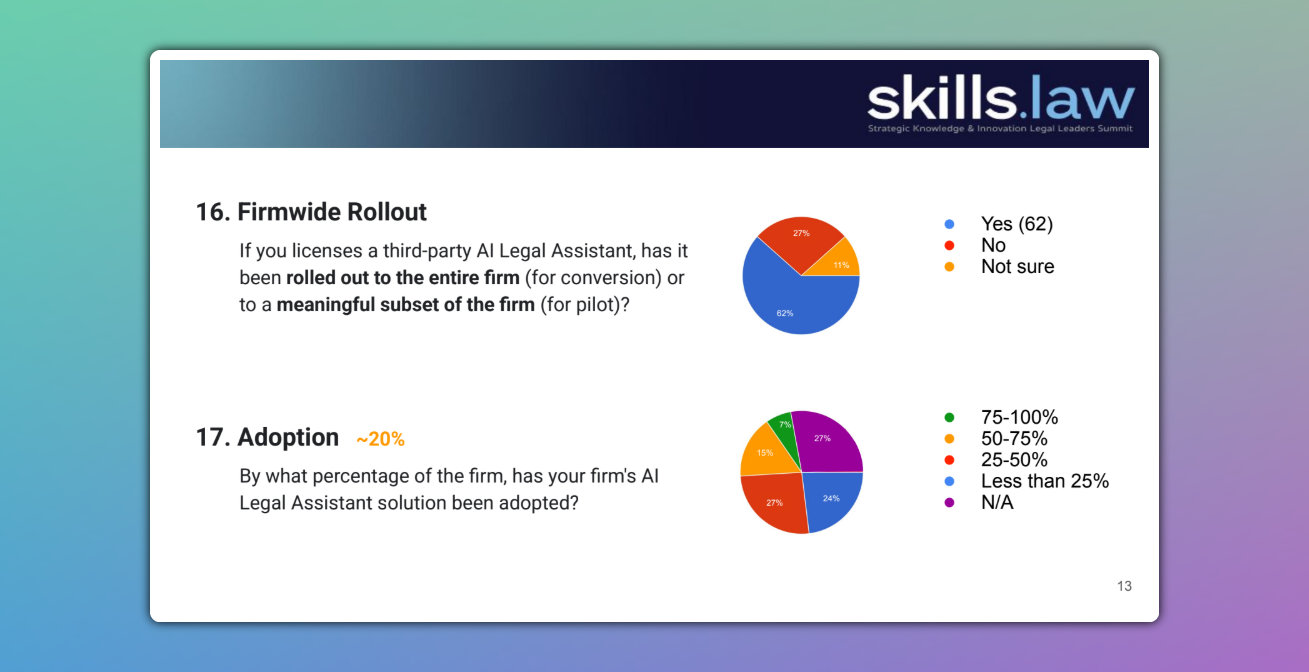

Artificial Lawyer noted that only about 20% of lawyers at the largest firms use their AI assistants regularly. This relatively low uptake is not surprising (historically, new tech sees slow adoption), and there’s optimism that usage will grow as GenAI tools become more integrated into daily work. Still, it’s a reminder that deploying a tool doesn’t guarantee it’s being widely used.

In their summary, they list the most-used AI products across all use cases. Interestingly, these include some long-established “legacy” tools: Contract Companion (a proofreading tool) is the single most-mentioned product (used by 61 firms), followed by Intapp Time (time entry software, 58 firms), and Kira (contract analysis, 53 firms). This suggests that law firms aren’t exclusively using shiny new GenAI tools; they continue to rely on proven tools that predate the GPT-era. As Oz Benamram noted, the dominance of Contract Companion (61% of firms) and Intapp Time (58%) suggests firms are not rushing to replace established solutions with new AI alternatives, instead, they’re augmenting existing workflows. In contrast, many of the newer GenAI tools appear in narrower use-case rankings, which we cover below.

AI Strategy and Governance

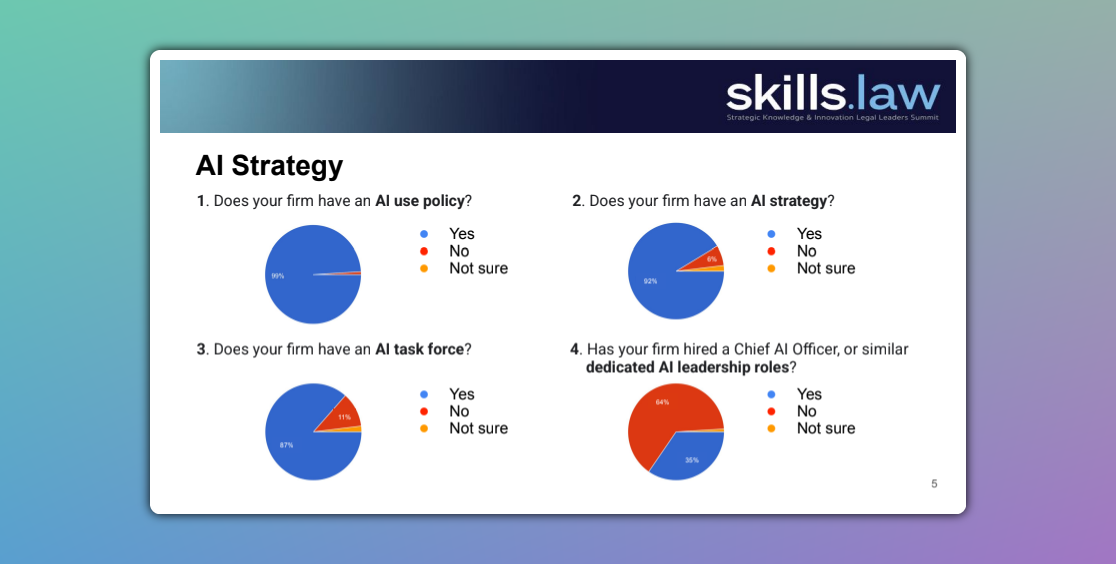

The survey covered questions on AI strategy, policies, and governance. The results show that all firms have implemented basic policies regarding AI usage. This high number reflects the urgency firms felt in 2023 to address confidentiality and risk issues once GenAI burst onto the scene.

Likewise, the vast majority (over 90%) of firms have developed a formal AI strategy. In practice, this means that most large firms have a documented game plan or task force driving their AI initiatives. Many have stood up AI committees or task forces to coordinate efforts across IT, innovation, knowledge management, and risk departments.

However, dedicated AI leadership roles are not common, only a handful of firms have gone so far as to hire a “Chief AI Officer” or similar dedicated AI lead. Most firms are tackling AI under the purview of existing leaders (e.g. Chief Innovation Officers or KM directors) rather than creating new C-suite positions just for AI. This makes sense given how new GenAI is, firms are still feeling out whether they need a single throat to choke for AI, or if existing governance structures suffice.

Who Drives AI Initiatives? One of the most striking shifts in this year’s survey is who is primarily responsible for executing a firm’s AI strategy. In the 2024 SKILLS survey, IT departments were leading AI at 74% of firms, with innovation teams playing a secondary role. In 2025, that dynamic has flipped. Innovation departments now lead AI strategy at 59% of firms, overtaking IT (43%). This is a dramatic change in one year, signaling that firms increasingly see AI as an innovation opportunity rather than just an IT project.

Innovation leaders who focus on emerging technology and practice transformation are taking charge of AI implementations in a majority of firms. It suggests that AI initiatives are being handled with a more exploratory, R&D-oriented mindset (common to innovation teams), rather than purely as technology rollouts by IT. Of course, every firm is different; some still house AI under Knowledge Management or other departments.

Innovation teams driving AI could mean faster experimentation and closer alignment with practice needs. These teams often work closely with lawyers to pilot new tools, run proofs-of-concept, and even co-develop solutions with vendors or clients. For law firm leaders, it may be worth evaluating whether your AI efforts have the right “home” internally, the consensus among peers seems to be that innovation (in partnership with KM and IT) is best positioned to spearhead generative AI projects.

Training and Upskilling Lawyers

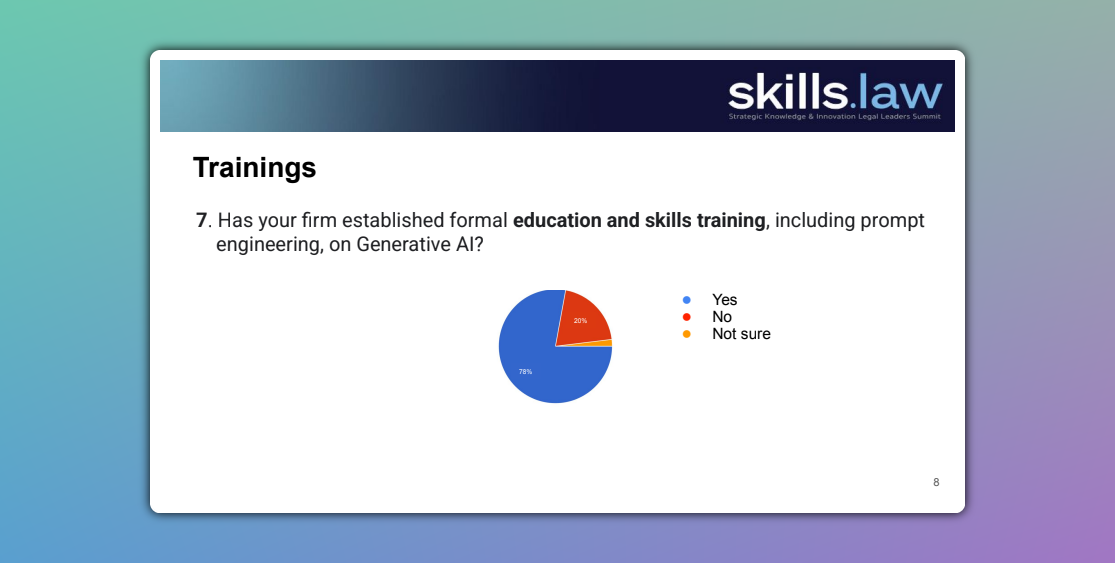

Another crucial piece of the AI strategy puzzle is lawyer training and education. The survey asked whether firms have established formal training programs on generative AI, including internal workshops on prompt engineering, guidelines for AI-assisted drafting, and other relevant topics. The survey shows that 59% of firms have implemented formal AI training for their attorneys and staff. In other words, roughly 3 in 5 big firms are actively trying to raise the AI proficiency of their workforce. This is a heartening number given that GenAI only hit the legal mainstream in 2023, firms have moved quickly to roll out education on these new tools.

The fact that 40%+ of firms haven’t yet started formal training also speaks volumes. It may be due to a “wait and see” approach or reliance on informal learning. But as the adoption of AI tools grows, we can expect more firms to follow suit with structured training programs. Some firms are creating internal certification programs or leveraging external courses to get lawyers up to speed on AI capabilities. The survey’s training statistic highlights that AI competence is now viewed as a necessary skill set, and firms are investing in building that internally.

For innovation leaders, a key takeaway is to ensure that your AI rollout is accompanied by robust change management. Plan for training sessions, internal demos, pilot groups, and maybe even “AI office hours” to support lawyers. The firms that lead in AI adoption often cite continuous education as a key factor in their success.

Internal vs. Client-Facing AI: Use Cases and Adoption

Looking at internal use cases of AI (for the firm’s own productivity) and client-facing use cases (where AI is built into services or products sold to clients), the data shows a clear emphasis on internal applications so far.

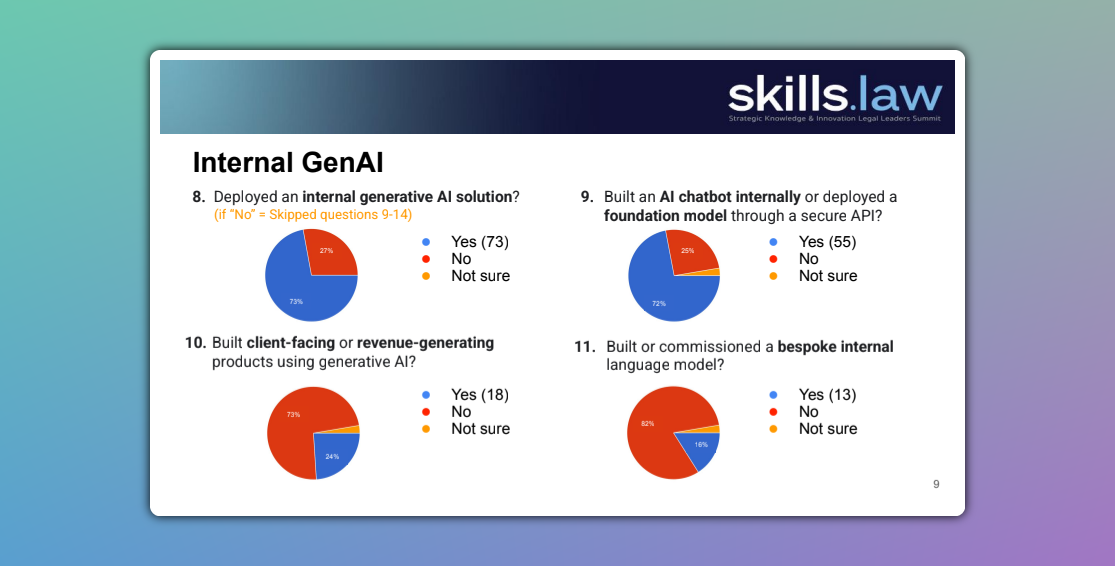

In response to “Has your firm deployed an internal generative AI solution?”, approximately 73% of firms answered yes. This indicates that a strong majority have at least one genAI tool live for internal use, whether that’s an AI legal research assistant, a contract analysis tool, an internal chatbot, or other productivity aids. Many of these are likely pilots, but they are in use within firms’ workflows (hence counted as “live”).

Contrast that with the answers to whether firms have built client-facing or revenue-generating AI products: only 18 firms (roughly 18%) said yes. In other words, fewer than 1 in 5 firms are directly productizing generative AI for clients at this stage. The vast majority are focusing on internal efficiency and productivity gains, rather than selling AI-based services. There’s a degree of caution here; firms are understandably careful about client-facing tech that could impact their business models or risk profiles. It’s much safer to experiment internally before taking AI to the client market. The implication for innovation leaders is that client-facing AI is a largely untapped opportunity.

Between internal and external use, internal experimentation clearly dominates. And even internally, adoption varies widely by use case. The survey identified 22 distinct generative AI use cases for law firms, ranging from well-established areas such as legal research and contract analysis to niche applications like patent drafting or e-discovery. Many firms are active in some use cases and not in others.

How Firms Are Building AI Solutions

An interesting set of survey questions explored how firms are implementing their internal AI solutions, building vs. buying, and the level of technical approach. The results show a mix of strategies:

- Building on Existing Models: A significant number of firms have chosen to build internal tools by leveraging existing large language models (LLMs) via secure APIs or integrations. For example, some organizations have built AI chatbots for internal knowledge retrieval or contract Q&A by leveraging models like OpenAI’s GPT. The survey indicates 72% have built an internal AI chatbot or similar solution using a foundation model through an API. This “build on top of someone else’s model” approach is quite common, it allows firms to create custom applications (like a firm-specific legal assistant chatbot) without developing the underlying AI from scratch.

- Training Custom Models: On the other hand, very few firms have gone the route of building or training their own bespoke LLM. Only 13 firms (≈16%) said yes to having built or commissioned a custom internal language model. Building a proprietary model is resource-intensive and likely beyond the appetite of most law firms at this stage. The ones who said yes might have partnered with AI labs or vendors to train models on specific data. But clearly, this is the exception, not the norm.

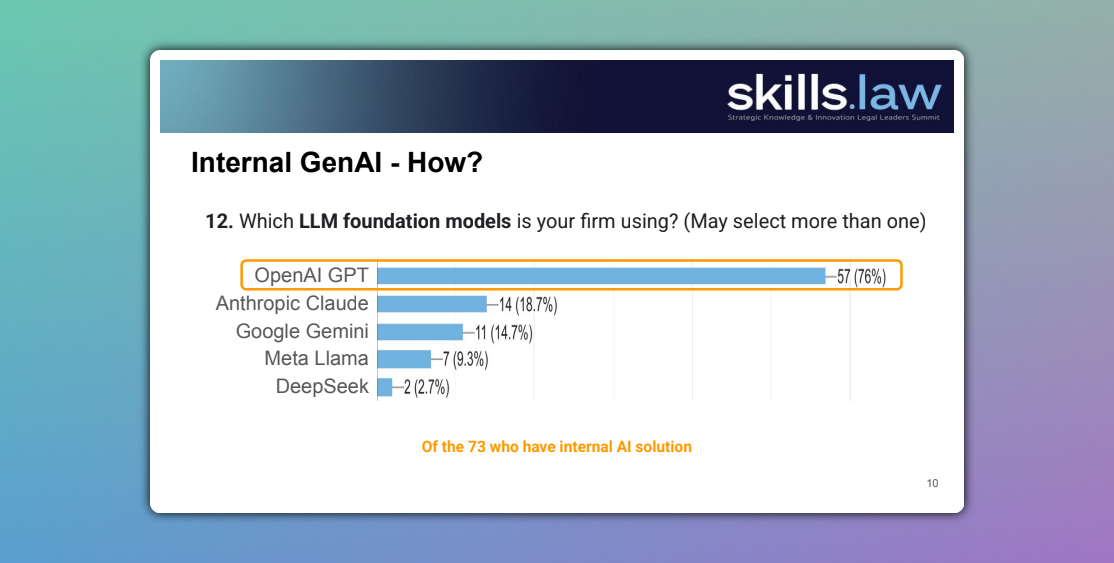

- Which LLMs Are in Use: The survey also asked which foundation models firms are using (multiple selections allowed). Unsurprisingly, OpenAI’s GPT family was among the most widely used, with many firms also experimenting with Anthropic’s Claude, and some looking at upcoming models like Google’s Gemini and Meta’s Llama. The takeaway is that OpenAI currently leads the pack as the go-to LLM provider for law firms, but alternatives are on the radar. Firms don’t want to be overly dependent on one AI platform, especially with the rapid evolution in this space.

- External Help and Partnerships: Importantly, many firms are not doing all this alone. When asked if firms used an external provider or consultant to support building any of these AI solutions. Around a 1/3 (33%) have partnered with vendors, legal tech companies, or consulting firms for their genAI projects.

AI Use Case Trends: Which Tools for Which Tasks (Slides 9–12)

The heart of the survey results lies in the breakdown of AI use cases and the tools firms are using (or have piloted or are considering) for each. The survey essentially mapped out, for 22 defined use cases, which products are in use and at what stage (live, pilot, or considering) across the respondent firms. While we can’t cover all 22 use cases here, a few categories stand out as illustrative examples:

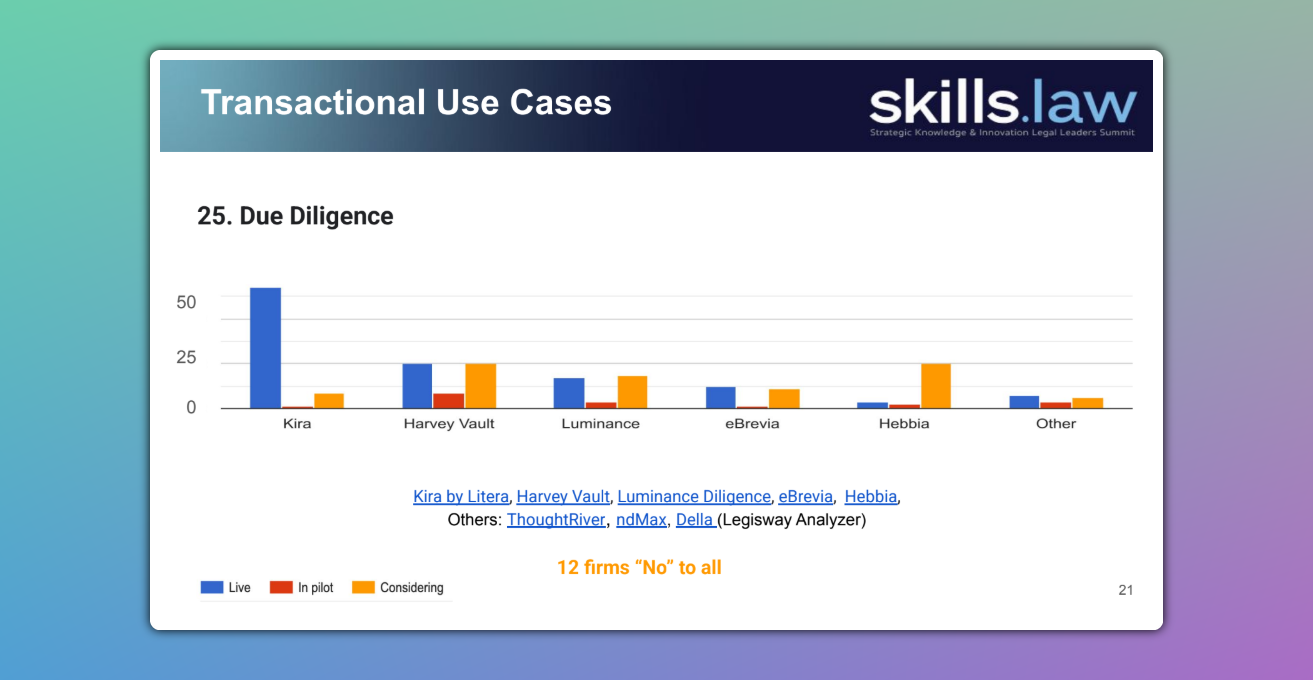

- Due Diligence: This is a classic use case (AI-driven contract analysis for deal due diligence or contract review tasks). According to the survey, Kira, an AI contract review tool dating back to the 2010s – remains the most popular tool in this category by a good margin. Kira’s longevity and training on vast contract datasets have kept it a favorite for document review. However, hot on its heels is a newer GenAI-powered entrant: Harvey. Despite being relatively new on the scene, Harvey has quickly gained traction and has come in as the second-most-used AI for contract review. Following those leaders, other earlier-generation tools like Luminance and eBrevia also have significant usage in this space. Due diligence AI is a crowded field, with no single tool monopolizing the market. Even a new player can capture attention quickly (as Harvey did), but the incumbents have not been displaced.

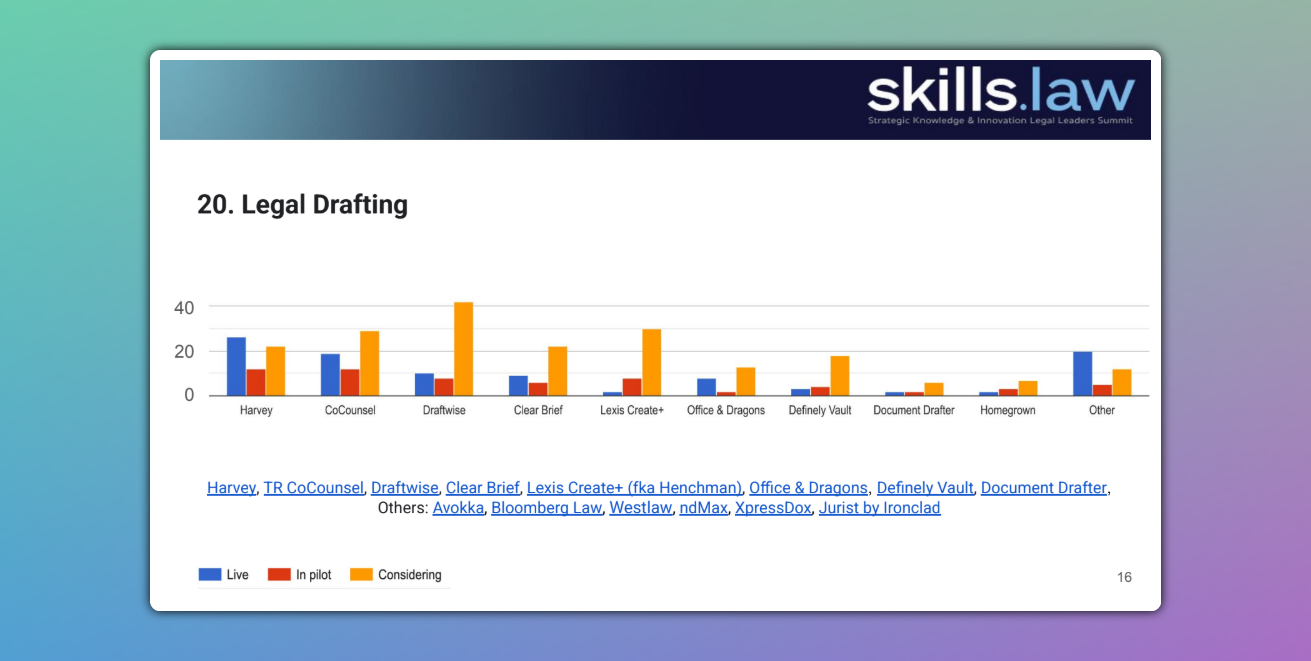

- Legal Drafting: For AI-assisted drafting of legal documents, we see a slightly different mix of tools. The survey results show Harvey as the top tool for drafting, narrowly beating out CoCounsel. This suggests many firms tested Harvey’s abilities in generating or editing drafts of memos, briefs, contracts, etc., and found it effective. Close behind, a number of firms are using DraftWise, ClearBrief, Lexis Create+, and Office & Dragons, among others, for drafting support. These tools each tackle drafting from different angles, e.g., DraftWise helps with contract clause suggestions, ClearBrief focuses on brief writing and citation checking, Lexis Create integrates drafting with research, etc.

- Search and Knowledge Retrieval (Slide 12): Another important use case is using AI for searching internal knowledge bases or document management systems (DMS). The survey results here had an interesting twist: Microsoft 365 Copilot came out on top as the most-used AI search assistant, at least at the time of the survey. If a lawyer can ask Word’s Copilot to find a clause or summarize a document without leaving their drafting environment, that convenience drives usage. However, close to half of the firms said they are “considering” a specialized AI search tool like DeepJudge for the future. DeepJudge is a newer AI-driven enterprise search for legal, and the high interest suggests firms are still looking for the best solution to search across their knowledge repositories. Also high on the consideration list was iManage Insight+, an AI-enhanced search feature from the popular DMS provider.

- Contract Negotiation/Redlining: The survey also looked at AI tools for contract negotiation support (redlining, suggesting clause edits, etc.). Here, Harvey and Thomson Reuters CoCounsel were the leading tools in use. This makes sense as both have features geared toward analyzing and revising contracts. But again, trailing close were DraftWise and Lexis Create+ with high interest levels. Many firms indicated they are piloting or considering these tools for negotiation tasks. For each use case category, the survey a long list of alternatives – a sign of a competitive and dynamic market.

Across all these use cases, one theme emerges: law firms are taking a portfolio approach to AI solutions. Instead of one AI system to rule them all, firms are deploying multiple specialized tools tailored to specific tasks. The survey’s 22 categories ranged from mainstream (e.g. document review, research, drafting) to emerging (e.g. visualizations/diagrams generation or automating discovery responses). Many firms are active in some but not others, depending on their practice needs and pain points.

Another data point: When asked if they have replaced any legacy solutions with generative AI solutions, most firms answered no. A few noted replacing tools in areas like document summarization or translation with GenAI alternatives, but generally, “Not replaced; augmented” was a common sentiment. In other words, firms are layering AI on top of existing systems rather than ripping out old software. This cautious approach aligns with what we see in product usage, the old and new co-exist, for now.

Additionally, the survey indicates some experimentation fallout: a number of firms tried certain AI tools and then abandoned them. For instance, 4 firms stopped using Harvey and 9 dropped CoCounsel, often citing high costs or lack of clear ROI. This kind of frank feedback is invaluable; it shows that law firms will pull the plug if a tool doesn’t justify itself. Cost, in particular, is on everyone’s mind. AI may be exciting, but business cases still matter.

Key Takeaways and Future Outlook

The SKILLS 2025 survey offers several practical takeaways for law firm innovation and KM leaders:

- Invest in a Broad AI Portfolio: Firms are finding value in deploying multiple specialized AI tools rather than waiting for one magic bullet. From the survey, even the highest-adoption tool is used by around half of the firms, meaning nearly half of firms use something else for that task or nothing at all. The field is wide open.

- Measure and Encourage Adoption: Having 18+ AI solutions “live” sounds great, but if only 20% of lawyers are actually using them regularly, the ROI will lag. Focus on change management – training (as ~59% of firms are doing), embedding AI into workflows, highlighting success stories, and maybe even mandating certain tools for tasks to build usage. Low adoption is a natural early-phase challenge; tackling it will distinguish the firms that truly reap AI’s benefits.

- Be Strategic, Policies and Strategy Matter: Nearly every firm now has an AI use policy and a formal strategy document. If your firm doesn’t, it’s time to create them. An AI use policy (even a basic one) is crucial to set guardrails (e.g. no client-confidential info in public AI tools, guidelines on verifying AI outputs, etc.). An AI strategy aligns leadership on goals, whether it’s improving efficiency by X%, offering new services, or upskilling staff. The survey shows that peers have these in place, so it’s an expected governance step at this point.

- Innovation (or KM/IT) Leadership is Key: Ensure there is clear ownership of the AI initiative. The trend is toward innovation leaders as owners, but choose the leader that fits your firm’s culture. What’s important is that someone (or some committee) has the mandate to drive AI projects forward, coordinate across silos, and report successes/challenges to firm management. Cross-functional collaboration remains vital; innovation, IT, KM, practice leaders, and risk all need to be in the loop.

- Partner Up and Learn from Others: Many firms are leaning on external providers to implement AI, whether that’s a vendor’s professional services team or a consulting firm with AI expertise.

- Monitor Costs and ROI: Some early adopters pulled back from tools due to cost/ROI issues. Build in evaluation periods for any AI tool: pilot it, gather feedback, and have clear metrics (time saved, increase in matter capacity, improved accuracy, etc.). For tools that do deliver, make the case to reinvest savings into broader rollout.

- Client-Facing AI, Cautiously Explore: With only ~24% offering AI to clients yet, this is an area of competitive advantage for those who figure it out early. It could be as simple as adding an AI contract analysis component to due diligence services, or a client portal that uses AI to answer routine questions. Any step in this direction should involve client input and likely start small. But don’t ignore this avenue, client expectations are evolving, and some clients may soon demand AI-enhanced efficiency from their firms.

- Augmentation Over Replacement: The survey responses, which indicate a preference for augmenting legacy systems rather than replacing them, are telling. The best approach for now is to integrate GenAI into existing workflows. Over time, if an AI-native solution proves vastly superior, firms might consider replacement.

For a closer look at the data behind these insights, readers can refer to the SKILLS 2025 survey slides.

Become a Fringe Legal member

Sign in or become a Fringe Legal member to read and leave comments.

Just enter your email below to get a log in link.